All our customers get access to AA Exclusive rewards & discounts on other products. Plus, AA Membership & AA Car Insurance customers get exclusive discounts on their AA Home Insurance!

Home Insurance

Save €115 on your Home Insurance + Get an extra 10% discount*

+ Get a €40 Retail Voucher!*

*Min premium of €218 & 5 years claims free. €115 discount applies to new business home insurance customers. Additional 10% discount applies to new business home insurance customers that currently hold an active AA Membership or Car Insurance policy & is only available on policies underwritten by AA Aviva / RSA. Read more T&Cs.

Why AA Home Insurance? 🏠

Protect what matters most. AA Home Insurance with Emergency Home Rescue as standard + more benefits that make it extraordinary.

With home insurance products to suit every home, you can compare to find a policy that suits you best.

AA Home Insurance Features and Benefits

Exclusive for AA customers, Protect your home with 24/7 immediate response!

As an AA customer you get:

- All inclusive starter pack with smoke alarms

- Alarm verification with cameras, day and night

- 24/7 monitoring with immediate response

- Highly visible burglar deterrent sign

With PhoneWatch, it’s all-inclusive

We don’t just protect your home, we fit seamlessly into your life giving you complete peace of mind.

- Your tailored security system protecting you against burglary, fire, flood and emergency situations

- Professional installation

- 24/7 monitoring with our Alarm Receiving Centre

- Immediate response under 15 seconds

- A direct line to the emergency services

- Free warranty on your products for the duration of your contract

- Free servicing and maintenance of your system

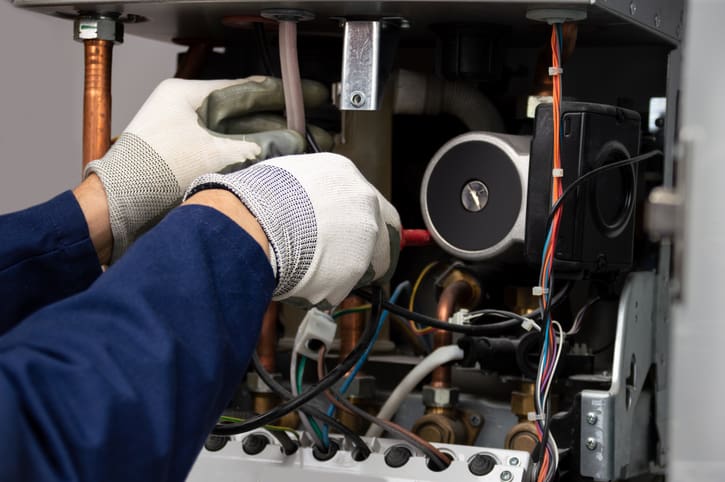

All AA Home Insurance policies now come with Home Emergency Assistance as standard. From drains cover to failure of internal electrics, we’ve got you covered should something unexpected happen. Read More

- Whether you’re working hybrid or have your home office fully kitted out, you can get cover for your personal home office equipment (i.e. equipment you own & not your employer) for up to €4,000**

- Also available for those looking to renew their home insurance.

- AA Home Insurance customers can claim up to €3,000 without affecting your no claims bonus**

- It’s one way we’re providing customers with extra protection on what is considered one of the most important parts of any house insurance policy.

- If you can’t live in your home due to a fire, damage, or another insured event, there’s no need to worry.

- When the unexpected happens at home, we will cover the cost of alternative accommodation.

- This benefit ensures your family has somewhere to call home for a little bit without issue.

AA Members save extra on home insurance, as well as increased cover for personal belongings and cash.** AA Members can also claim up to €6,000 without affecting your no claims bonus‡

You can avail of benefits like Christmas & Wedding Gifts Cover, Fire Brigade Charge Cover, Content in Garden Cover, Family Personal Accident & Public Liability Insurance.

Check our full list of home insurance benefits

Please note, the cover listed above is only available on AA common product policies (Aviva and RSA). Please see Cover Summary for more details on AA common product, RedClick, AA Allianz and AA AXA.

AA Home Membership – Home Emergency Rescue

With AA, Home Insurance policies now come with 24/7 emergency home assistance cover as standard. From plumbing issues, to heating or electricity problems, you can enjoy your home knowing help is at hand for these household emergencies without affecting your no claims bonus¹

Kitting out your home takes time and substantial investment. AA Home Contents Insurance protects you from any loss or damage to all your essential belongings. Our contents cover is also there for the minor inconveniences you wouldn’t even think of, like protecting the contents of your fridge & freezer, power cuts, and even when you’re on jury service.

Read More Get a quote

As a landlord, the inability to look after your property daily can feel like more risk is involved. Anyone acting as a landlord can get protection against loss or damage to a rental property with AA landlord insurance, which covers everything from third-party claims to water mage.

Read More Get a quote

Protect your home away from home with AA Holiday Home Insurance. We cover any third-party claims, water damage and even up to €1,000 in loss of oil for new and existing AA customers. Give yourself peace of mind, with third-party claims, and make sure your holiday home (and outside contents) gets protected with our help.

Read More Get a quoteFAQs for Home Insurance

Home insurance generally covers damage to the structure of your home, personal belongings, and liability for accidents that occur on your property. Covered events typically include fire, theft, vandalism, and some natural disasters like storm or flood damage. However, specific coverage and exclusions can vary depending on your policy. For example if you live in a flood prone area, your insurer may have this as an exclusion on your policy.

Home insurance typically does not cover damage from typical wear and tear, pest infestations, and issues caused by lack of general home maintenance. Separate policies may be needed for any exclusions.

This depends on the cost to rebuild your home (not just its market value), the value of your personal belongings or contents. You should ensure you have enough coverage to fully replace your home and possessions in the event of a total loss. You can find an estimate of your rebuild costs here

Yes, you can insure specified items on your home insurance policy, there may be an additional premium for this. If you’re looking to add any specified items, you can easily do so on The AA Webchat with our Home Insurance customer service team. It would be beneficial to have a valuation ready to be sent to our customer service team

To file a claim, contact your insurance company as soon as possible. Document the damage with photos or videos and make a list of damaged or lost items. You’ll also need to provide proof of ownership for expensive items. Follow the insurer’s claims process, which might include a visit from an adjuster to assess the damage. You can contact our home insurance first notifications claims line on 1800 100 001

Yes, most home insurance policies include personal liability coverage. This covers legal and medical expenses if someone is injured on your property, or if you accidentally damage someone else’s property. It can also cover legal defence costs if you are sued. To find out how much is covered, read over your policy documents you have received from the AA.

No, all of the letters of indemnities issued are sent directly to the policyholder, once you receive this you will need to forward over to your mortgage provider to avoid any complications with them. These letters are found in your new business or renewal documents and are usually headlined as “notice of interest” letter.

No claims bonus protection is only available on policies underwritten by RSA or Aviva. This cover offers protection for claims up to €3,000 without your no claims bonus being affected, AA Members with Breakdown Assistance get increased benefits with these underwriters of protection up to €6,000.

Learn more about Holiday Home Insurance from the Recent Blog Posts....

With AA home Insurance, you’ll have peace of mind 🙌

With AA home Insurance, you’ll have peace of mind 🙌

We’ve been trusted by our customers for over 100 years.

Enjoy your home, without the unexpected worries.

Rated ‘Great’ by our customers on our latest review. You’re in good hands.

Already Insured with us? 🤝

Hopefully you won’t need to get in touch, but should something change. We’re here.

Switch to AA TodayTerms and Conditions

*Min premium of €218 & 5 years claims free. €115 discount applies to new business home insurance customers. Additional 10% discount applies to new business home insurance customers that currently hold an active AA Membership or Car Insurance policy & is only available on policies underwritten by AA Aviva / RSA.

* cont. Quotes generated & purchased online only during offer period. Further terms & conditions apply. Offer ends 30th April 2025. Further T&Cs apply.

**Available on owner occupied policies only. Acceptance criteria, terms and conditions apply.

‡Acceptance criteria, terms and conditions apply.

¹Cover up to €250 per emergency. Maximum 4 emergencies per 12 month period of insurance.

∞A fully installed home security alarm system may qualify you for a reduction in your Home Insurance premium. Purchase AA Home Insurance & get a Phone Watch house alarm pack and install for €29. Any additional fees charged at standard pricing. Monitoring fees apply. 12 month contract applies. Offer ends April 30th. Cannot be used in conjunction with another offer.